“Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

– Albert Einstein

Compound interest truly is the 8th wonder of the world. And as you’ll see in this article, it doesn’t just apply to the world of finance.

As humans, we tend to overweight the short-term and underweight the long-term. It’s difficult to make short-term sacrifices when the payoff seems so far out into the future. But if you can delay immediate gratification, the long-term rewards tend to be greater than you could ever imagine.

I’m so passionate about this topic because I’ve experienced all of this first hand. The moment I started thinking longer term, my life improved dramatically. I started a thriving business, began accumulating wealth, and got in the best shape of my life. I truly believe that if our society adopted a lower time preference, we’d all be much better off for it.

In this article, I want to demonstrate why it pays to play the long game and how you can shift your mindset to take full advantage of it.

The Basics of Compounding

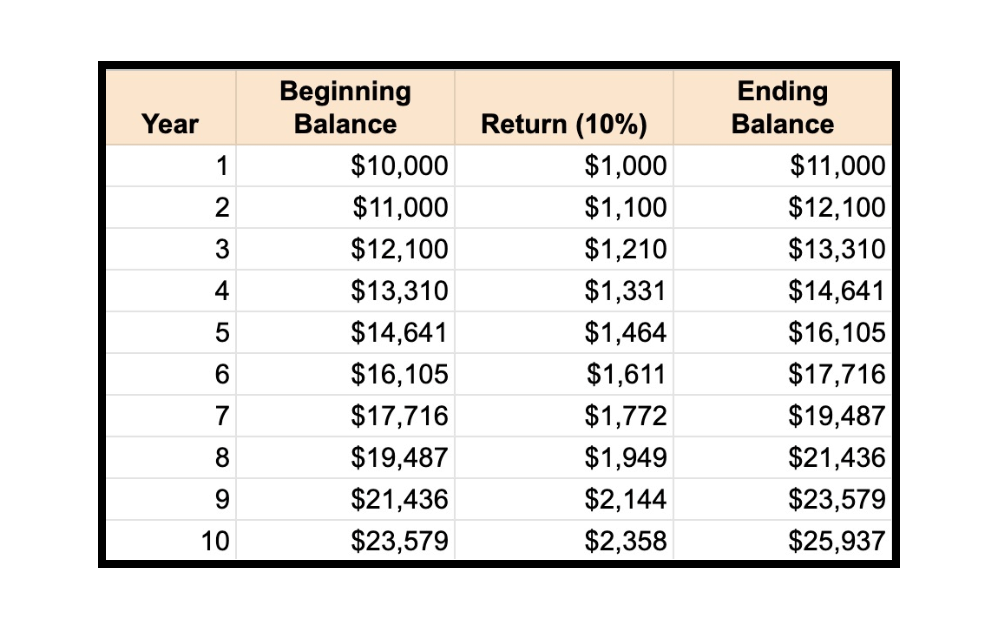

Before we can really dive into the concept of playing the long game, we need to cover the basics of compounding first. To do so, let’s pretend you invested $10,000 in an S&P 500 index fund, which anyone can purchase in a brokerage account.

Since the S&P 500 index has averaged an annual return of 10%, we’ll use that as the basis for our calculations. For simplicity sake, I’m going to ignore the impacts of inflation and taxes (which wouldn’t apply anyways if you invested in a tax-sheltered account).

Notice that in year 1 your return was only $1,000 ($10,000 x 10%). However, in year 10, you would have generated a return of $2,358 even though your rate of return was constant at 10%. This is the magic of compounding. The more time that passes, the higher your absolute return will be.

To simplify this even more, we can use the rule of 72, which is a way to determine how long an investment will take to double. To do this, we simply need to divide 72 by the annual rate of return.

Going back to our example with a 10% rate of return, if we divide 72 by 10 we get 7.2 years. If you refer back to the table above, you’ll notice that our investment had an ending balance of $21,436 in year 8 which is more than double our initial investment of $10,000. The math checks out.

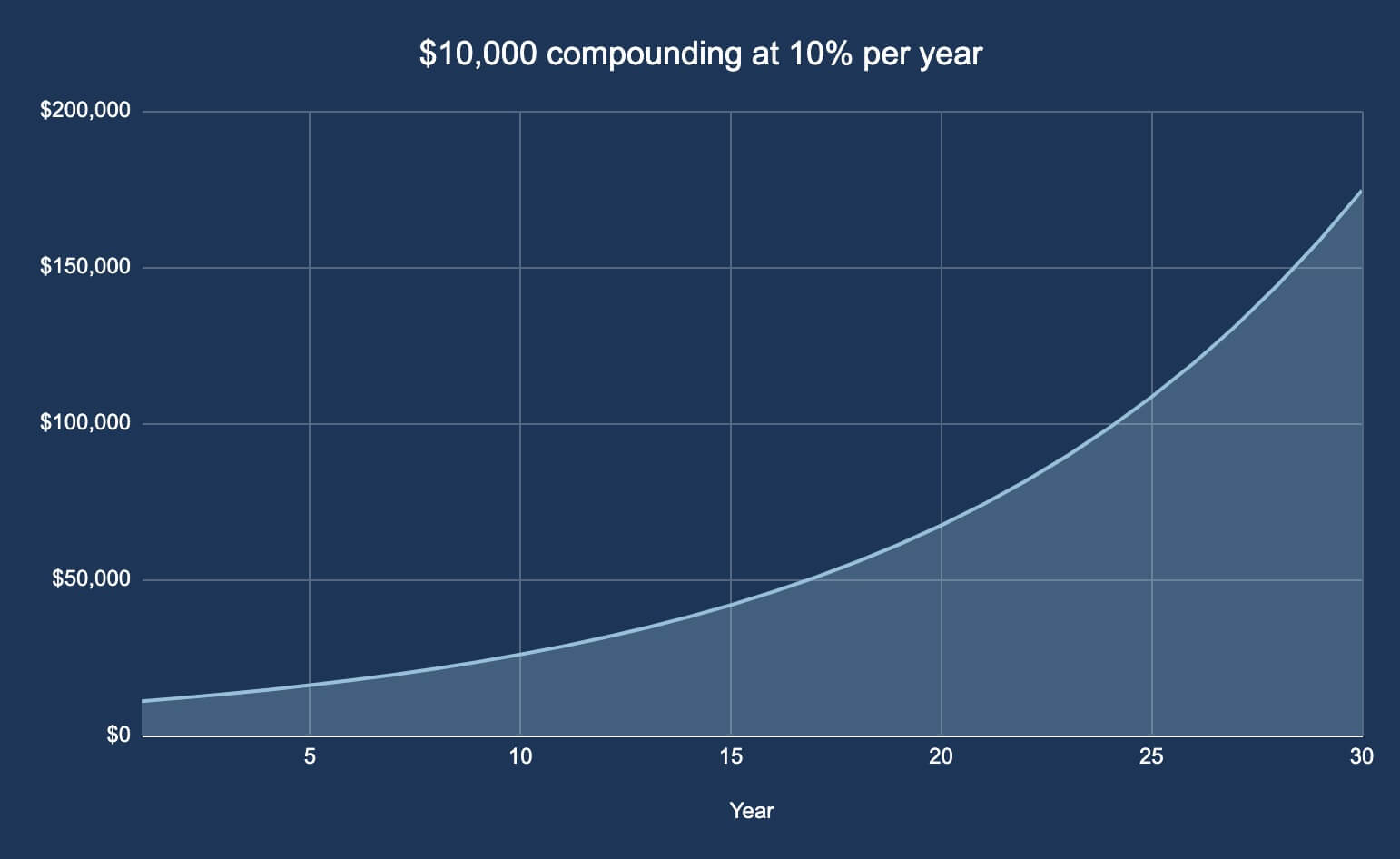

Now imagine if instead of investing $10,000 in an S&P 500 index fund, you opted to purchase a state of the art home theatre system instead. Not only would you have $10,000 less in your bank account, you’d also give up the opportunity to have $20,000 in just over 7 years.

This is what we call opportunity cost. Every time that you spend a dollar, you’re foregoing the opportunity to double that money every 7.2 years (assuming a 10% rate of return). If we plot this over a 30 year time horizon, here’s what the graph looks like.

Notice how the slope of the graph keeps getting steeper over time? Again, this is the power of compounding.

Now I’m obviously making some assumptions here so please don’t get too caught up in the actual numbers. There’s just two very important concepts I want you to take away from this section which can be applied to all areas of your life and we’ll expand on them in more detail throughout this article.

Takeaway #1: Most decisions in life are a tradeoff between short-term satisfaction and longer-term gain.

Takeaway #2: Assuming a constant rate of compounding, results get exponentially bigger over time.

The Case for Entrepreneurship

As you just saw, investing your money in a diversified index fund over several decades is a great way for the average person to grow their wealth over time. For what it’s worth, I also think that having an allocation to Bitcoin is a must for the decade ahead.

The only issue with investing is that the amount of money you’ll be able to accumulate largely depends on how much money you can plow into the market. Naturally, this will be highly correlated to your salary (assuming you keep expenses low and don’t fall victim to lifestyle creep).

As long as you’re working a job, you’re always going to be trading your time for money. And unless you possess extremely in-demand skills where you can charge a lot of money for your time, you’re unlikely to become extremely wealthy through traditional employment.

Now, there’s absolutely nothing wrong with having a traditional career. In fact, there can be a lot of advantages to working a job especially if you have a great employer and you find your work fulfilling. I’m just pointing out the simple fact that your earning potential will always be capped as long as it’s tied to the number of hours worked.

So how do you detach earning potential from hours worked? That’s where entrepreneurship comes in!

Without a doubt, starting a business is the ultimate way to play the long game.

“Entrepreneurship is living a few years of your life like most people won’t, so that you can spend the rest of your life like most people can’t.”

– Anonymous

That quote may be cheesy AF, but there’s certainly a lot of truth to it.

Before I co-founded Snappa, I was following the traditional life script to a T. I went to university, had a fairly high paying job, and was on the path to retiring at 57 years old with a good pension.

The problem was that my job wasn’t fulfilling, I didn’t have a lot of freedom, and my earning potential was always going to be capped no matter how hard I worked. So, as I detailed in my backstory, I ended up launching various side projects with my business partner Marc, and eventually took a leave of absence from work.

If I only thought about the short-term, I would have never made that decision. In order to take that leave of absence, I had to take a massive pay cut, dial back my spending, and even dip into my savings.

However, by lowering my time preference, I knew that investing in myself would pay off.

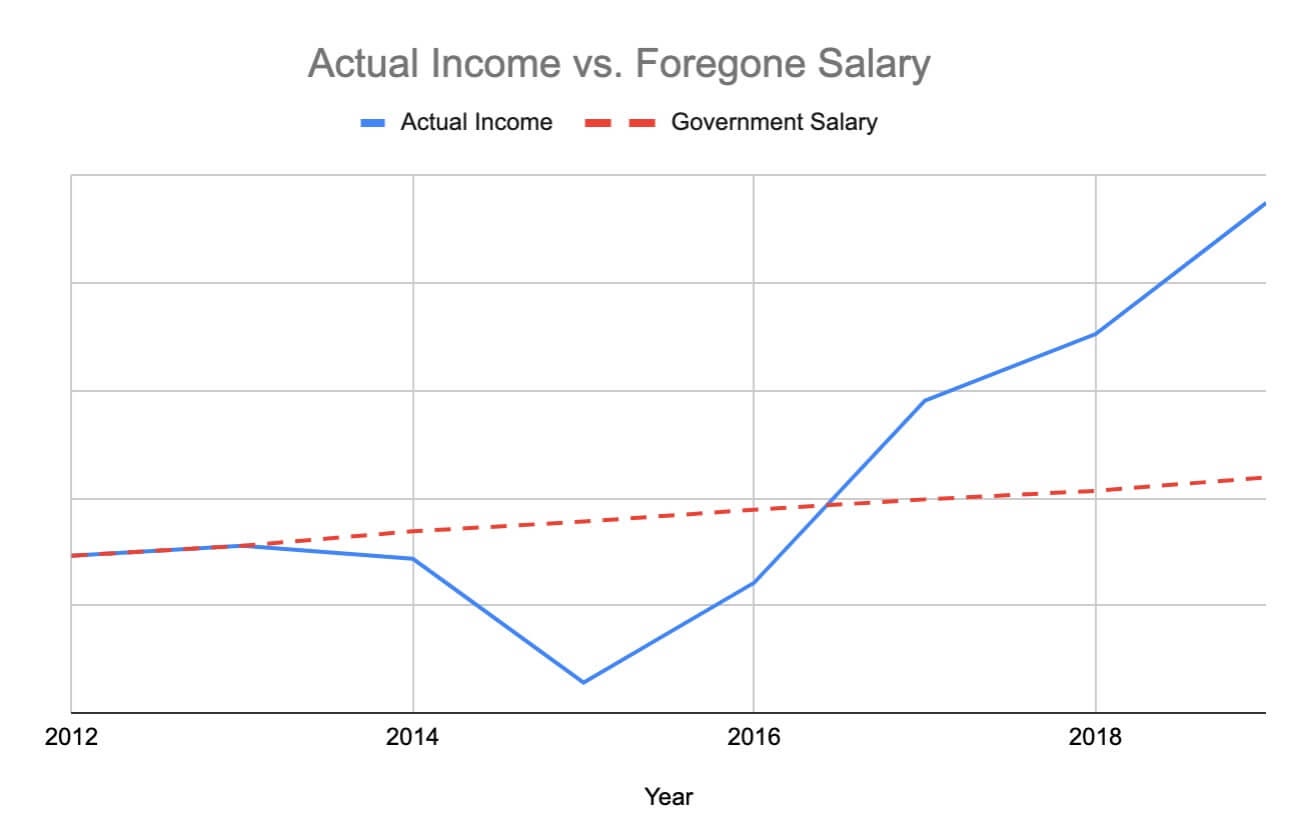

I now have the benefit of hindsight and this post might suffer from survivorship bias but that was the best decision I’ve ever made. As Dan Andrews predicted with the 1,000 day principle, it took about 3 years to replace my corporate salary after I took my leave of absence. Since then, my personal income has grown past what would have been possible had I continued working my corporate job.

Here’s a graph showing this phenomenon. The solid blue line is my actual income from 2012 – 2019 and the dotted red line shows what my salary would have been had I stayed employed in the government (it accounts for pay increases baked into the collective agreement).

You can clearly see that in the short-term, staying employed would have been a much better decision from a financial standpoint. However, once I got past the initial dip, leaving the government was clearly the better decision especially when you factor in all the other benefits of being my own boss.

Here’s where things get even more interesting…

If we take a look at Snappa’s annual recurring revenue (in $USD), you’ll notice that it just keeps going up and to the right. In fact, it actually began accelerating in 2019 and even more so in March of 2020 when COVID-19 hit. It took more than 4 years to make our first million dollars of ARR but we’ve already added another $500k just in the last 5 months alone!

This is the undeniable power of the long game.

How is this possible? It turns out that marketing is another form of compound interest.

As part of our marketing flywheel, we began investing in content marketing and SEO back in 2016. As you can see from my recent Twitter thread, the returns from this investment are continuing to compound over time. Over the last 4 years we’ve grown our organic traffic from practically nothing to just shy of 1M sessions per month.

In 2016 we decided to focus heavily on content + SEO as our core marketing channel. As you can see from the graph of our organic traffic, this channel has really paid off for us.

Here are some of my thoughts around growing traffic with SEO 👇 [Thread]

— Christopher Gimmer (@cgimmer) July 14, 2020

If someone would have told me back in 2016 that Snappa would be doing $1.5M ARR today with a team of seven I would have never believed them. Yet here we are!

Health & Longevity

So far I’ve talked mainly about playing the long game as a way to accumulate wealth and improve your financial position.

However, long term thinking is also incredibly important across all other aspects of life. None of which is more important than health and longevity.

After all, what’s the point of having lots of money if you won’t be around to enjoy it? Or even worse… what if you live a long time but your quality of life sucks due to poor health?

The biggest issue with health and fitness is that bad decisions often take a while to show up in test results or in front of the mirror. Eating one shitty meal and skipping one workout doesn’t seem like a big deal and won’t make a big difference in isolation. However, if you compound this type of behaviour and keep justifying it by telling yourself you’ll “get back on track next week,” you’re setting yourself up for disaster.

This is how most people find themselves overweight and out of shape and it always seems to sneak up on them without them even realizing it. Once the damage has been done, it’s really tough to lose the weight and get back on track.

But you know what’s a hell of a lot easier? Not letting yourself go to begin with.

Admittedly, I’ve recently made this mistake myself. Throughout my 20s I’ve always stayed in pretty good shape and always kept up at the gym. However, after I started a business, I used that as an excuse to slack off with both diet and exercise and my fitness suffered as a result. On top of that, I kept doing these short-term bulking and cutting cycles where I was basically just spinning my wheels.

Eventually I got to the point where I wasn’t happy with my appearance so I hired Emil Goliath to whip my ass into shape and teach me everything he knows about training. We actually met a few months prior at a rooftop party in Bangkok where we were both attending a business conference.

Over the next 5 months I started eating properly, hitting the gym 5x per week, and I completely transformed my body. There was nothing fancy about what we were doing, just simple principles applied consistently.

Here are the before and after pics:

Transformations like this are difficult because the biggest changes happen towards the end of the journey. After the first two weeks, I didn’t notice a huge difference and this is where a lot of people throw in the towel.

However, I was building muscle behind the scenes and I just needed to burn more fat to make it all visible. During the last month, my body fat percentage got low enough where the muscle I built really began to show and I looked more ripped than I ever did in my entire life.

In the book Atomic Habits by James Clear, he describes this concept as the Plateau of Latent Potential.

In the beginning, results will lag behind your expectations. James refers to this as “the valley of disappointment.” Again, this is where most people throw in the towel because they’re not seeing the progress they anticipated.

However, if you keep at it, you’ll eventually cross over the line and suddenly your results will start to exceed your expectations. At this point, you’re thrilled that you kept going because it all became worth it in the end.

This is exactly what I experienced both building a business as well as getting back into shape. The beginning was very slow and often lagged expectations, but eventually the magic of compounding took over and I was blown away by what I achieved.

When it comes to health, it’s extremely important to look at things through a long term lens. Skipping one workout will often lead to weeks of not working out and a few bad meals will often lead to months of poor eating.

Don’t allow yourself to fall prey to short-term thinking which you will undoubtedly pay for in the long run. Similarly, if you’re disappointed by a lack of results in the short-term, keep pushing through and you’ll be rewarded handsomely in the long run.

The Big Picture

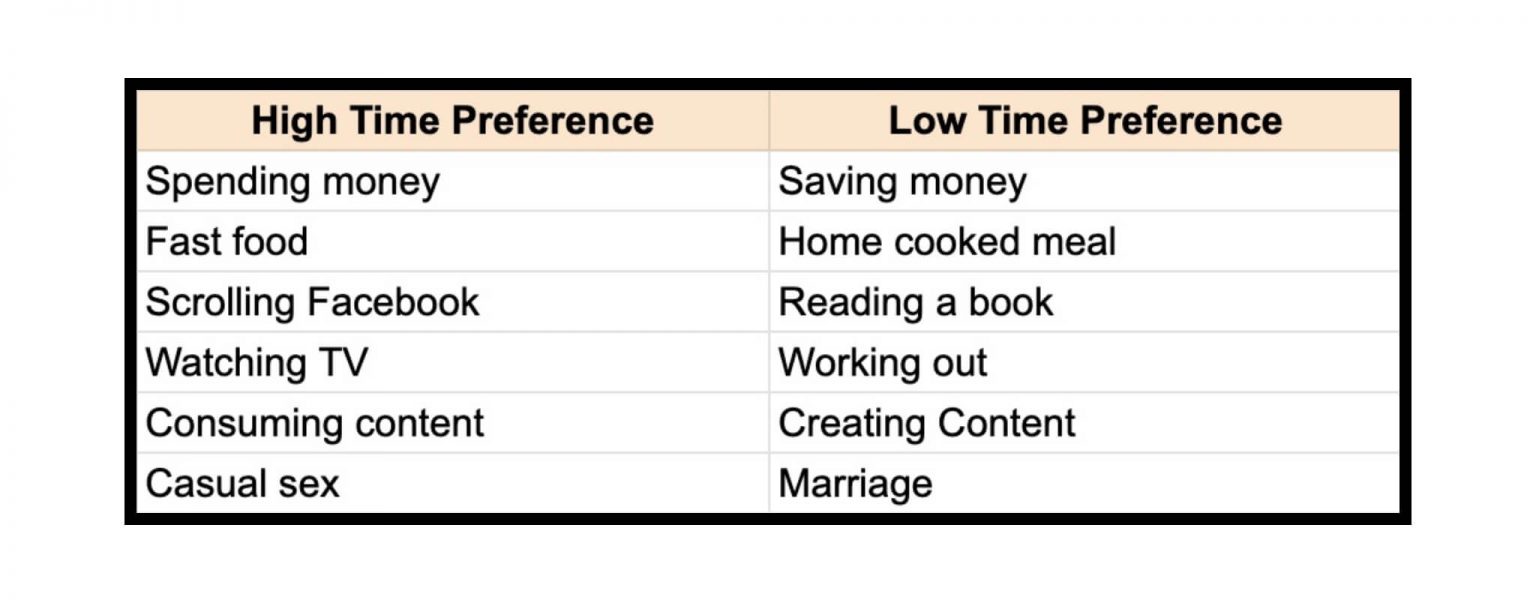

In this article I’ve focused mainly on the power of long term thinking as it relates to building wealth and improving your health because that’s where I’ve experienced the most dramatic impact on my life.

However, lowering your time preference can improve all areas of your life. Here are just a few simple examples contrasting a high time preference with a low time preference which can help you start changing your mindset.

Now don’t get me wrong… I still watch Netflix and eat fast food here and there. We’re all human and we need to enjoy life.

The takeaway is that you should gravitate towards low time preference decision making as often as possible. By focusing on the long term, the power of compounding will work in your favour and you’ll be absolutely amazed at what you can accomplish.